The performance of shopping centers is vital to the Australian economy.

Many of the properties are managed by large property groups, and super funds and insurance groups invest to obtain the reliable income from these properties. Centers account for about 38% of the retail space in Australia and more than one third of retail outlets, however, the retail space per person is only about 50% of that in the U.S. This leaves the doors wide open for huge expansion which will probably come from the largest property owners.

CFS Retail

Recently restructured CFS Retail Property Trust Group or CFX owns a portfolio of $13.8bn. Although 28 properties are wholly or partially owned by CFX, third-party or wholesale funds have interest in 15 assets.

Scentre Group

The result of the restructure of the Westfield group became Scentre. It is the largest owner in Australia with 38 centers across the country.

Its malls account for 11135 retail outlets in 3.4m m² of space. The group has an acquisitions and development programme with a $4.9bn value.

AMP Capital

AMP owns 17 centers In Australia and nine in New Zealand, generating $6bn in sales each year.

Federation Centres

Federation manages 58 centers worth $4.3bn.

Lend Lease

This group manages 17 regional and sub-regional centers across Victoria, WA, NSW and Queensland. Its $4.7bn portfolio is owned mostly by partners and investment funds. It has $1bn in developments in progress.

Dexus Property Group

Dexus has $15bn invested across various commercial properties in Australia, New Zealand, the US and Europe. Its portfolio is geared toward neighbourhood and sub-regional centers.

Explore the top 10 Australian fashion brands making waves with unique styles and creative craftsmanship.

The deal will be closed in the third quarter of 2023.

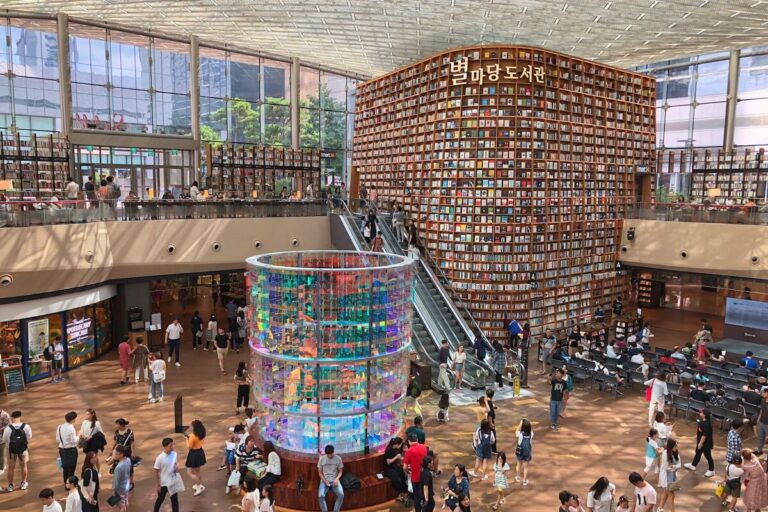

Seoul is one of the most developed markets not only in the Asia-Pacific region but also in the whole world.

Central Pattana unveils The Central, a new US$575m mall in Bangkok’s fast-growing northern district with a planned opening in late…

Singles’ Day 2025 breaks new global records with $150B+ in sales. Discover the top categories, data insights, and retail trends…

MixC Shenzhen Bay opens in Shenzhen’s Nanshan district, blending luxury retail, art, and lifestyle into one destination, redefining the Asian…