Investment company Sycamore Partners refuses to acquire a controlling stake in the American lingerie retailer Victoria’s Secret.

Investment company Sycamore Partners refuses to acquire a controlling stake in the American lingerie retailer Victoria’s Secret. The deal worth $525 million was under threat of failure, said the parent company L Brands.

April 22, 2020, it became known that Sycamore Partners intends to terminate the agreement to purchase a 55% stake in one of the world’s largest lingerie producers. Representatives of the investment company have initiated a lawsuit to invalidate the agreement.

Sycamore Partners notes that the terms of the deal were violated, as the owner of Victoria’s Secret brand closed stores around the world and did not ensure payment of rent payments. When agreements to buy a business were reached, the parties did not specify the negative impact of the pandemic. In turn, L Brands intends to achieve compliance with the terms of the agreement for the sale of shares in the retailer.

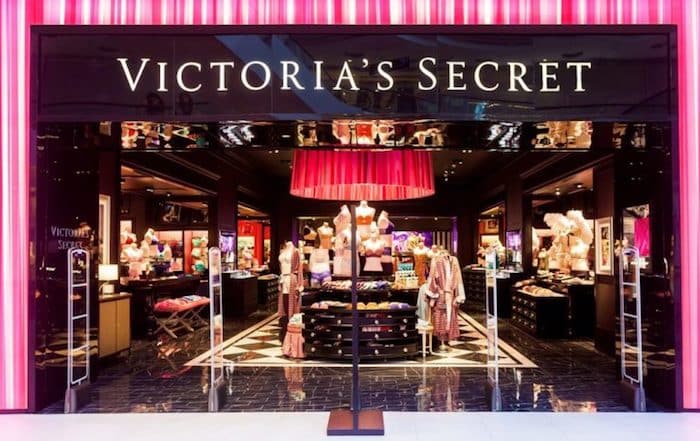

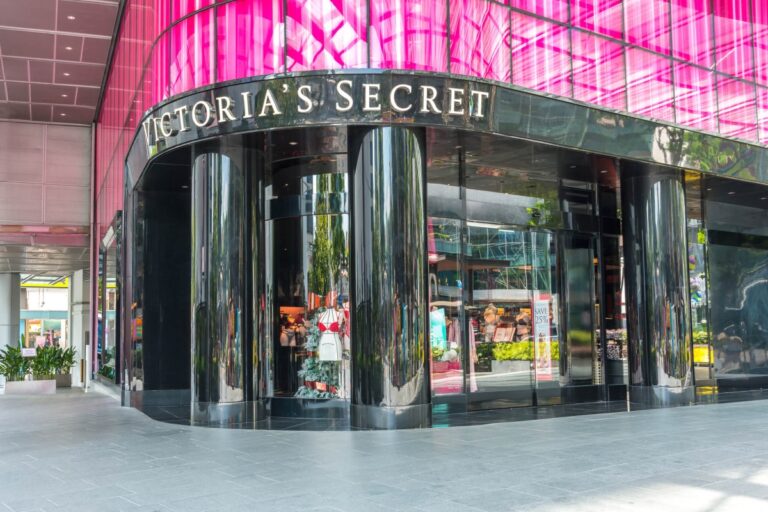

The deal was announced in February 2020. The company, which owns Victoria’s Secret Lingerie, Victoria’s Secret Beauty and Pink brands, was valued at $1.1 billion.

Victoria's Secret staged its first runway show in six years in New York, bringing back its iconic "Angels" format.

The partnership began in April 2022 with the launch of cosmetics sales.

The U.S. lingerie giant disclosed plans on Wednesday to open the store in the Highpoint Shopping Centre.

57 verified brand expansion signals. 25+ markets. Seven archetypes. One structural pattern.

In-store retail media crossed $0.5B. AI moved from the cloud into checkout scanners. Retail space supply hit historic lows.

3-4 November 2026, Cannes MAPIC takes place every autumn in Cannes and remains one of the few global events where…