Shopping center investment volumes for H1 have reached £2.73bn in the UK.

Transaction volumes for UK shopping centers reached £2.73bn for 28 centers during H1/2014, way up on H1/2013 of £2.23bn. During Q2/2014, 15 centers transacted for £1.42bn, the same as Q1/2014 of £1.31bn for 13 centers. The largest deal during 2014 was the sale of the 30% Lend Lease share in Bluewater Shopping Center, Dartford. It accounted for 49% of the overall volume during Q2.

Eight centers had offers by the close of Q2, to a total value of £800m. This includes 50% in Cabot Circus, Bristol for £270m with NIY of 6.25% reported in Q1, and 50% in Telford Shopping Center for about £200m, with NIY of 6%. Currently, 31 centers are being marketed openly to a value of £1.23bn, showing a good available stock level. These are mostly small or large lot sizes and portfolios. A lack of stock exists with prices between £20m and £50m and the demand for such lot sizes is strong among property companies and UK retail funds. Stock is expected to continue attracting competitive bidding.

The current weight of money has hardened yields in Q2/2014 for all center sub-sectors and the inward trend is continuing. Super-prime yields are no at 4.5%, supported by Bluewater’s 30% transaction at the end of H1.

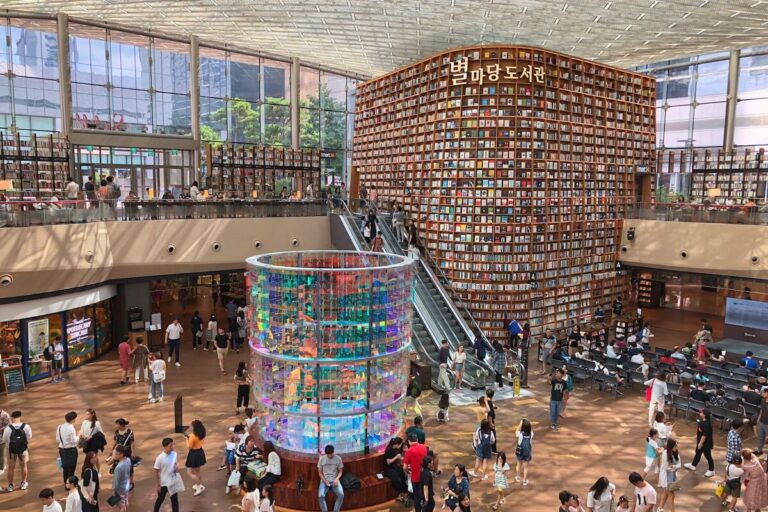

Seoul is one of the most developed markets not only in the Asia-Pacific region but also in the whole world.

Nicolas Houzé, CEO of Galeries Lafayette, has outlined ambitious growth plans for 2024.

Central Pattana unveils The Central, a new US$575m mall in Bangkok’s fast-growing northern district with a planned opening in late…

Singles’ Day 2025 breaks new global records with $150B+ in sales. Discover the top categories, data insights, and retail trends…

MixC Shenzhen Bay opens in Shenzhen’s Nanshan district, blending luxury retail, art, and lifestyle into one destination, redefining the Asian…

From Nike’s storytelling to IKEA’s precision and Glossier’s human tone—the best retail press releases don’t just announce, they connect.