The development of European shopping centers is predicted to accelerate, with 9.1 million m² due to be delivered over 2016 and 2017.

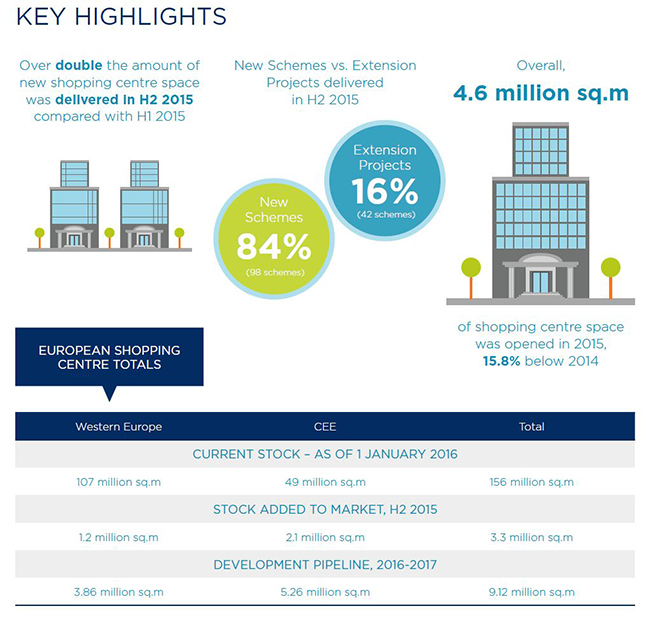

The European Shopping Centre Development Report by Cushman & Wakefield showed that 2015 delivered one of the lowest annual volumes of the past decade, with 4.6 million m² of shopping centre space opened representing a 15.8% fall on 2014. This was despite the fact that the second half of 2015 saw 3.3 million m2 of new shopping centre space open its doors – more than double H1 figure, bringing the European total stock to 156 million m² by the end of the year.Despite a slow year in 2015, shopping centre development is expected to accelerate over the next two years, with 9.1 million m² currently in the pipeline and due to be delivered over 2016 - 2017.

From an investment perspective, across Europe €15.5bn was invested in shopping centres in H2 2015, representing a 16.6% year-on-year growth. The UK and Germany remain the most sought after markets, accounting for over 45% of total trading volumes.

The report shows that London retains the top position as a destination for shopping centre development. The city’s low shopping centre density – 231.2m² per 1,000 people – combined with its strong retail sales growth of 15.8% by 2020, makes it a key market for future shopping centre development.

Elsewhere in the UK, core cities such as Edinburgh, Manchester, Birmingham, Leeds, Glasgow and Bristol will offer encouraging environments for new businesses and are forecast to see high retail sales growth over the next five years.

Madrid and Barcelona are expected to experience high retail growth, with combined retail sales of 12% by 2020. This will be a key factor in supporting future European growth. In contrast, German and French cities are forecast to display weaker growth at 6% by 2020 in core German cities and 7.5% in core French cities.

Solid growth prospects in shopping centre provision are seen in Central and Eastern Europe (CEE), including Ankara, Istanbul, Sofia, Prague and Riga. In the second half of 2015, the trend in CEE was a focus on building new sizeable shopping centre projects, such as the 110,000m2 Zelenopark in Russia, the 61,500 sq m Podium Ankara in Turkey and the 51,000 sq m Zielone Arkady in Poland. Extensions of existing centres represented only 12% of total new space added, and this is predicted to continue, accounting for just 9% of the total amount of new space added in 2017.

25 APRIL 2016,

Source:

Cushman & Wakefield

Boohoo expands online presence with new marketplace for fashion

Boohoo expands online presence with new marketplace for fashion Victoria's Secret expands presence in Melbourne

Victoria's Secret expands presence in Melbourne Inditex's Bershka set to enter indian market with Mumbai store

Inditex's Bershka set to enter indian market with Mumbai store Ross stores expands across the U.S. with 24 new locations

Ross stores expands across the U.S. with 24 new locations Chaumet opens doors to debut boutique in Italy

Chaumet opens doors to debut boutique in Italy Birkenstock is launching first store in France

Birkenstock is launching first store in France Salomon elevates brand presence with new Paris flagships

Salomon elevates brand presence with new Paris flagships  Amiri expands presence in California

Amiri expands presence in California  Crocs expands its presence in India with Apparel Group

Crocs expands its presence in India with Apparel Group  Best Buy Canada to expand presence with 167 small-format locations

Best Buy Canada to expand presence with 167 small-format locations  Arket expands into Italy with Milan flagship

Arket expands into Italy with Milan flagship