IMMOFINANZ Group offers to the tenants in its five Moscow shopping centers a general FX-fixing for their rents for a limited period of three months.

The fixation is based on an exchange rate of 40 Rubles for 1 USD or 50 Rubles for 1 EUR (which corresponds approximately to the exchange rate level at the beginning of October 2014) and will last fr om January until March 2015.

The offer is for those tenants wh ere no individual agreements for a rent reduction have been previously agreed. The offer also stipulates that tenants fully repay any outstanding rents by the end of February 2015.

„We have always emphasized and also proven in the past that we support our tenants as part of a long-term partnership. The sharp drop in the Ruble and loss of purchasing power of Russian consumers have put many retailers under pressure. Our offer for a temporary FX-fixing of rents will allow a quick solution before year-end for those retailers with whom we haven’t already agreed on a temporary reduction”, says Eduard Zehetner, CEO of IMMOFINANZ Group. “We do not expect any significant improvement in the situation in Russia over the short-term. However, we believe in the Russian market and in Russia as an economic factor and we will overcome the current difficulties together with our tenants.”

The effects of these measures on the business development of IMMOFINANZ in Russia depend on the acceptance of the offer by tenants and ongoing exchange rate developments. Therefore it cannot be currently estimated. On the one hand, these measures will lead to further temporary reductions of rental income. On the other hand, tenants will have the opportunity to repay outstanding rents at a more favorable FX rate than the current one.

IMMOFINANZ Group owns and operates five shopping center in Moscow with a rentable space of close to 277.000 sqm, among them Golden Babylon Rostokino and GOODZONE, which was opened in 2014.

These malls have become popular destinations for shopping, dining, and entertainment, from luxurious brands to local boutiques.

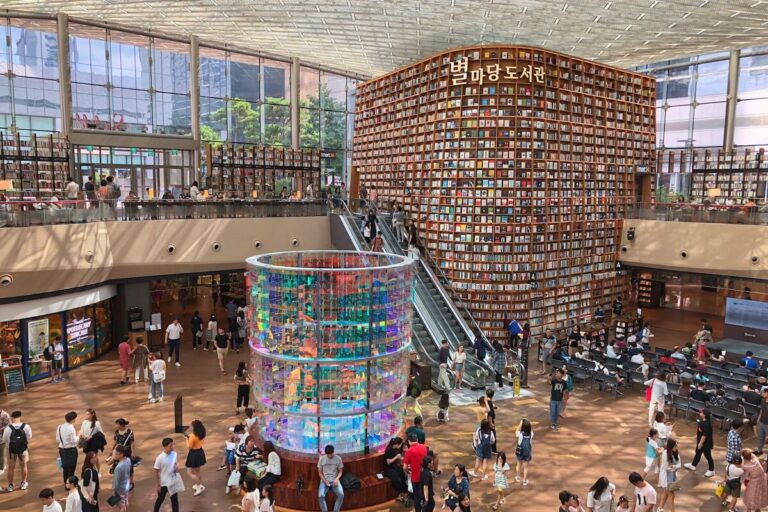

Seoul is one of the most developed markets not only in the Asia-Pacific region but also in the whole world.

In-store retail media crossed $0.5B. AI moved from the cloud into checkout scanners. Retail space supply hit historic lows.

3-4 November 2026, Cannes MAPIC takes place every autumn in Cannes and remains one of the few global events where…

Las Vegas · May 2026 · Las Vegas Convention Center ICSC Las Vegas takes place each year in May and…

World Retail Congress takes place each spring in London and brings together senior retail executives, investors, and property leaders for…