Blackstone Group LP (BX) have agreed to the sale of a majority share in 39 shopping centers in the US to Kimco Realty Corp (KIM).

Kimco will purchase the two-third interest held by Blackstone in the properties based in Maryland, California, Florida, Texas, Virginia and New York, covering 5.6 million square feet. The company confirmed that the transaction value is $925m, inclusive of debt.

The sale by Blackstone comes as it commences marketing of a new global real estate fund. The private equity firm from New York took the second-largest shopping center landlord in the US, Brixmor Property Group Inc (BRX) public during October 2013. Kimco has been simplifying its holdings by selling off some of its lower-quality assets, thus reducing its joint ventures.

Blackstone purchased the interest in the Kimco venture during June 2013 for around $733m, inclusive of debt, from the UBS Wealth Management North American Property Fund. The financial details have not been made public but there is speculation that the firm invested around $260m of equity. Blackstone has declined any comment.

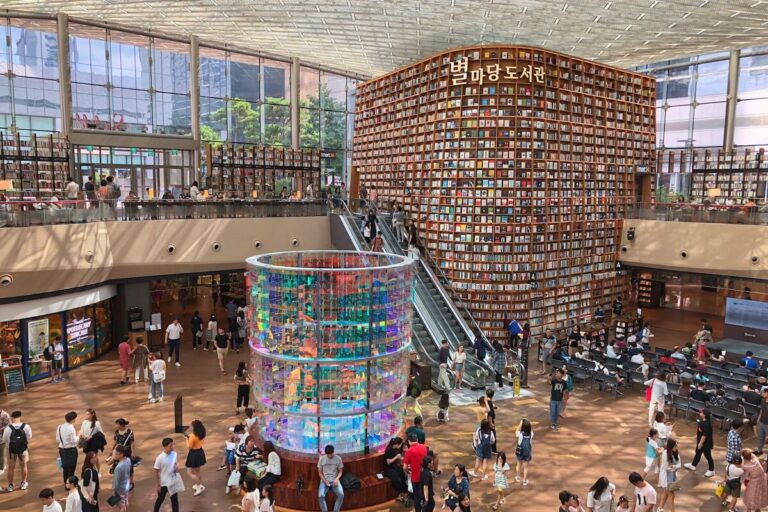

Seoul is one of the most developed markets not only in the Asia-Pacific region but also in the whole world.

Each store will cover an average area of about 5,000 square feet.

Central Pattana unveils The Central, a new US$575m mall in Bangkok’s fast-growing northern district with a planned opening in late…

Singles’ Day 2025 breaks new global records with $150B+ in sales. Discover the top categories, data insights, and retail trends…

MixC Shenzhen Bay opens in Shenzhen’s Nanshan district, blending luxury retail, art, and lifestyle into one destination, redefining the Asian…

From Nike’s storytelling to IKEA’s precision and Glossier’s human tone—the best retail press releases don’t just announce, they connect.