A report from Moody’s the big four supermarkets in Britain will have no choice but to cut prices further in a bid to compete with Lidl and Aldi.

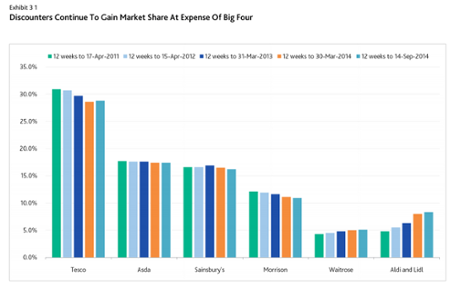

Asda, Morrisons, Sainsbury’s and Tesco will be forced to reduce prices in an attempt to slow down the rate of declining sales and business loss to Aldi and Lidl. However, according to Moody’s, the large grocery retailers will not be able to win this war as they attain only half their historical average operating margins.In spite of the potential price cuts, the discount stores will continue to steal market share from the big four. Although the sales growth of Aldi and Lidl will potentially slow down, they intend opening more stores, which will result in added pressure on the big supermarket chains.

The habits of consumers changed drastically during the recession, resulting in them shopping more often, locally and in smaller quantities. As real wage values continued to decline, consumers chose to save money at the smaller German discount stores, rather than making a weekly trip to the big four’s huge stores.

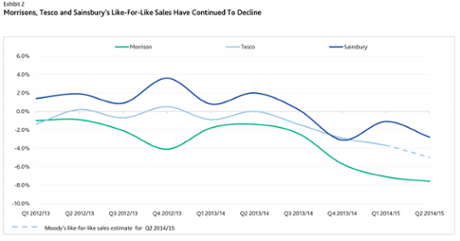

Morrisons has been particularly hard hit by the growth of the discount stores and has pledged to cut prices on many of their items. Analysts are expecting Dave Lewis, Tesco’s new chief, to further reduce prices. Sainsbury’s has been pulled into the war as well, despite initially trying to stay above the price war.

Analysts expect operating margins to decline to an average of 2.5% over the next year or year and a half, which is down from the current 3% and about half the average in the past. Further price cuts may put additional pressure on Tesco’s credit rating, which was cut during June to only two notches above the ‘junk’ category.

Lidl and Aldi are both strong enough to give the big four a run for their money as far as price cuts and advertising campaigns are concerned. The Aldi UK bosses have vowed to do whatever is necessary to undercut their rivals and stated that the big four would never be able to match them on price.

The former boss of Sainsbury’s, Justin King, dismissed the popularity of Aldi and Lidl as a periodic boost of sector competition and said the price war was nothing more than a ‘skirmish’. Analysts at Moody’s said the discount stores now form part of the retail landscape in the UK and consumers have been bitten by the discount bug.

Although an increase in real wages will ease the pressure on household finances, consumers who switched to the discount stores will find it difficult to switch back to paying high prices, even if their financial situation was to improve. The discount stores have both improved their store offerings with a bigger range of products, including premium ranges, and a huge proportion of their products are now being sourced from within the UK.

Moody’s conclusion is that the big four will have to accept what has happened and cut costs. Expansion into online and convenience may allow them to compete more effectively with Lidl and Aldi, who do not operate this type of store. The big four would have to make huge amounts from online sales to compete, and in this scenario Morrison’s may be in the best position as it operates fewer big stores and has centralized distribution centers for online sales.

24 OCTOBER 2014, United Kingdom

Boohoo expands online presence with new marketplace for fashion

Boohoo expands online presence with new marketplace for fashion Victoria's Secret expands presence in Melbourne

Victoria's Secret expands presence in Melbourne Inditex's Bershka set to enter indian market with Mumbai store

Inditex's Bershka set to enter indian market with Mumbai store Ross stores expands across the U.S. with 24 new locations

Ross stores expands across the U.S. with 24 new locations Chaumet opens doors to debut boutique in Italy

Chaumet opens doors to debut boutique in Italy Birkenstock is launching first store in France

Birkenstock is launching first store in France Salomon elevates brand presence with new Paris flagships

Salomon elevates brand presence with new Paris flagships  Amiri expands presence in California

Amiri expands presence in California  Crocs expands its presence in India with Apparel Group

Crocs expands its presence in India with Apparel Group  Best Buy Canada to expand presence with 167 small-format locations

Best Buy Canada to expand presence with 167 small-format locations  Arket expands into Italy with Milan flagship

Arket expands into Italy with Milan flagship