Documents:

The world’s dominant commercial real estate markets have moved into 2014 in better shape than at any time since the Global Financial Crisis of 2008-2009. Capital markets are exhibiting remarkable strength and the disconnect, that has emerged over the past two years between a more cautious occupational market, is showing signs of narrowing.

This latest edition of Global Market Perspective presents an encouraging picture of a global real estate market that is regaining its pre-crisis vigour:

The global economy is steadily improving, GDP growth is accelerating, and higher business confidence and perceptions of fewer downside risks are spurring corporations to spend again. Crucially, the U.S. economy and real estate market look finally to be gaining some traction.

The real estate investment market is displaying exceptional liquidity in both the equity and debt markets, with a huge weight of money chasing commercial property, as evidenced by:

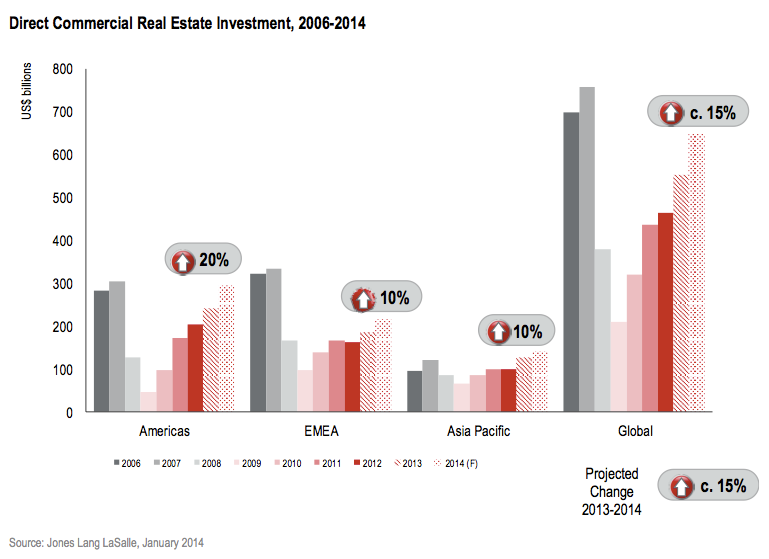

– Full-year 2013 sales transactions up 21% to US$563 billion

– Q4 2013 volumes hitting nearly US$200 billion; a level not seen since mid-2007

– 24 countries achieving in excess of US$1 billion in transactions during Q4

– Several major markets registering record transaction levels in 2013, including China, Australia, Canada and Singapore

– Further prime yield compression and an acceleration in capital value growth, increasing by an average of 7.5% year-on-year for prime office assets

Very strong competition for a limited stock of core assets is forcing investors up the risk curve, into ‘non-core assets in core markets’ and ‘core assets in non-core markets’. For example:

– Global investment volumes in the hotel sector were up a massive 40% in 2013, while industrial transactions in Europe grew by 70%

– Second-tier cities, such as Seattle, Atlanta, UK regional cities and Osaka, are capturing a greater proportion of real estate capital

– Investors are seeking out markets that until recently were considered ‘out of bounds’, notably in Southern Europe where there has been a rapid change in sentiment

– Investors are also targeting value-added opportunities and moving into development in order to access product

A buoyant investment market is being assisted by a robust recovery in the debt markets. This is most evident in the U.S where debt capital providers are boosting funding levels to new post-recession highs. CMBS issuance was up a significant 78% in 2013 to US$86 billion, a level that could well exceed US$100 billion this year. The European debt markets are lagging, but are nonetheless also showing strong improvement.

Deals already in the pipeline point to further growth in global investment activity during 2014. JLL’s initial forecasts indicate volumes of US$650 billion, a 15% uplift on 2013 levels and representing the fifth consecutive year of growth.

Several factors point to continued investment market momentum over the coming year:

– A substantial weight of capital is sitting on the sidelines looking for product; and a broad range of investors have

announced intentions to make fresh commitments in 2014

– New capital sources are constantly emerging, with a surge of new capital anticipated from Asia and specifically China, which is exporting capital on a large and increasing scale

– More product is expected to come onto the market as vendors take advantage of the current market cycle

– Further growth in activity in secondary markets and assets is anticipated, supported by better access to finance

Meanwhile the occupational markets are exhibiting early signs of a more sustainable recovery. Improvements are uneven however - corporate occupiers are still exercising caution and remain firmly focused on value:

– The office leasing markets in the U.S. are now showing a much more cohesive recovery, with volumes up 7% year-on-year. Europe’s volumes bounced back by 18% during Q4, with London taking a clear lead. In Asia Pacific, volumes rose by 6% in Q4, although leasing activity remains mixed across this diverse region.

– The technology and energy sectors continue to be the main drivers of corporate occupier activity, while improving prospects are also apparent in insurance and life sciences. Confidence is gradually spreading to other business sectors, and corporate demand in 2014 is likely to be more broadly based than in either of the last two years. Even the finance sector is showing ‘signs of life’, accounting for the largest deal in London during the last quarter.

During 2014, corporates will be less capital constrained and, with higher business confidence, there should be greater willingness among senior business leaders to authorise capital expenditure, contributing to a 5-10% uplift in leasing volumes during the year. We also predict more expansion demand, with net absorption up by 20-25% globally, although the paucity of supply may constrain some expansion plans.

The development pipeline across all commercial sectors is largely under control, and shortages of high-quality space will intensify during the year. Construction levels are well below trend, but early evidence points to an uptick in development starts during 2014 and 2015. Even so, new deliveries will be below trend until 2016.

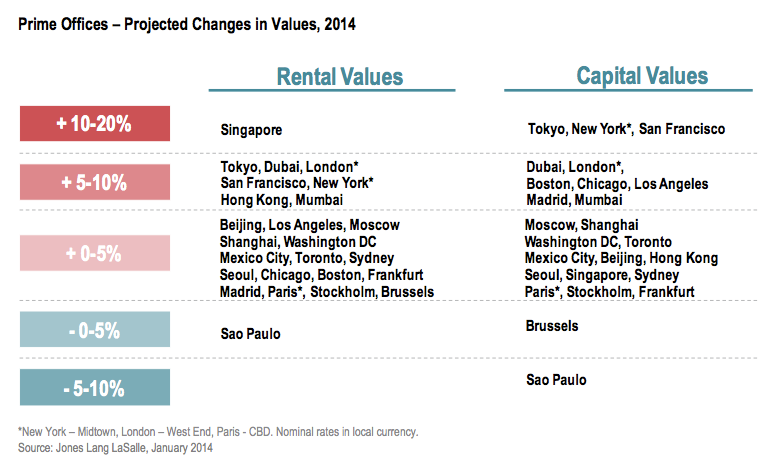

Rental growth for prime offices is expected to gain pace from the weak 1-2% rates of 2012 and 2013, increasing over 4% in 2014. Growth will be led by several supply-constrained global gateway cities – such as Singapore, Tokyo, London, New York and San Francisco - where there is potential for double-digit rent increases.

As we move into 2014, optimism is certainly the prevailing mood in the global real estate markets, but downside risks remain that could temper activity and suppress confidence during the year. The impact of tapering and rising interest rates on global capital flows is an underlying concern, particularly for emerging markets. In the occupational markets, cost and efficiency are still at the forefront of corporate mindsets, and business sentiment could quickly be dented by renewed macroeconomic instability. Nevertheless on balance, our prognosis for the global real estate market is more positive than at any time since launching our Global Market Perspective in 2008.

Salomon elevates brand presence with new Paris flagships

Salomon elevates brand presence with new Paris flagships  Amiri expands presence in California

Amiri expands presence in California  Crocs expands its presence in India with Apparel Group

Crocs expands its presence in India with Apparel Group  Best Buy Canada to expand presence with 167 small-format locations

Best Buy Canada to expand presence with 167 small-format locations  Arket expands into Italy with Milan flagship

Arket expands into Italy with Milan flagship