Documents:

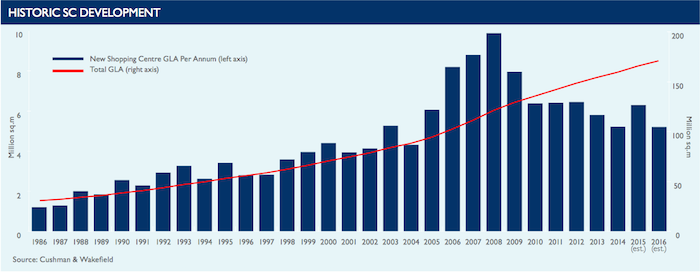

Total shopping centre floorspace in Europe increased by 3.3% over the twelve months to the end of 2014 totalling 152.3 million sq.m. Although Western Europe currently accounts for 69% of total built GLA, development activity in Central and Eastern Europe (CEE) surged ahead in H2 2014, with 2.2 million sq.m of space delivered to the market compared to 981,000 sq.m in Western Europe. Russia – responsible for nearly half of all shopping centre space added in the last six months of 2014 (1.6 million sq.m) – has now become the largest market in Europe, with total floorspace at over 17.7 million sq.m and overtaking France with 17.66 million sq.m of built shopping centre space. The UK takes the third position with 17.1 million sq.m of built space.Russia has now become the largest market in Europe

Development activity throughout Europe has been motivated by the need to meet consumer demand for larger centres offering a greater diversity of retailers, an array of leisure activities and a wider choice of food and drink offerings. Western Europe’s biggest markets have seen an increasing number of extensions and refurbishments as developers seek to ‘future proof’ small or outdated centres, while CEE is still dominated by the creation of new, dominant regional centres that serve a wide catchment area. These trends will continue over 2015 and 2016, with Russia and Turkey continuing to dominate the development pipeline as overall density in these countries remain low – albeit the completion of projects in Russia will be subject to financing conditions, which are now morelimited than they were 12 months ago. In Western Europe, development activity in markets with lower densities, such as Italy and Spain, are also gaining momentum; indeed, Italy’s pipeline is expected to more than double that of the UK over the next two years.Shopping centre investment in 2014 reached €21.1 billion, with a strong performance from the UK as it again accounted for almost a third of all transactional activity across Europe, alongside standout performances by Spain, France and the Netherlands. In Western Europe, a shortage of prime stock in many countries is leading investors to seek the best opportunities in secondary markets in their search of higher yields. As investor search areas expand, Central Europe is back on the agenda for many, with strengthening economic fundamentals boosting the Czech Republic in particular – a new hotspot for international investors. In Eastern Europe, there has been a significant dip in trading volumes due to falling activity levels, seen particularly in Russia as investors act with caution and remain hesitant over geopolitical tensions at play and sanctions that are currently in place.

Salomon elevates brand presence with new Paris flagships

Salomon elevates brand presence with new Paris flagships  Amiri expands presence in California

Amiri expands presence in California  Crocs expands its presence in India with Apparel Group

Crocs expands its presence in India with Apparel Group  Best Buy Canada to expand presence with 167 small-format locations

Best Buy Canada to expand presence with 167 small-format locations  Arket expands into Italy with Milan flagship

Arket expands into Italy with Milan flagship