Documents:

Volumes

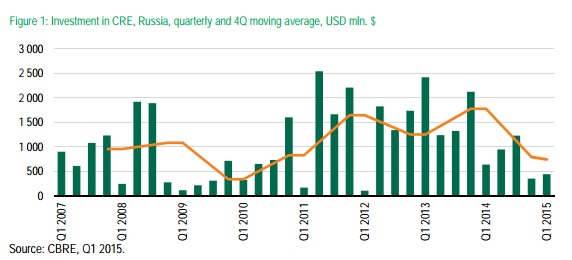

In Q1 2015 total investments in Russian commercial real estate market amounted to USD 439 mln., which is 31% less than in Q1 2014, but 25% more than in Q4 2014.

Macro factors, influencing investment activities, indicated quite positive trends at the beginning of 2015 :

• GDP decline in Q1 2015 might be significantly lower than 3%, contributing into more optimistic expectations for the indicator in the whole 2015, as well

• Downward pressure on rents weakened and develops in line with the baseline scenario for 2015:

- in the office segment they decreased on average by 5-15%,

- in the I&L segment – stabilized,

- in the retail sector situation is still quite complicated under the adverse influence of decline in retail sales by 7,7% in February, 2015.

• In February - March 2015 Rouble indicated trend on appreciation despite decline in the CBR key rate, repayments of external debt and relatively low oil prices.

Information about acquisition plans of a few large investors appeared in Q1 2015. Cross-border players are among those, who consider potential acquisition targets. Realization of these plans might increase investment volumes in 2015 by more than USD 0.5 – 1 bn.

All above mentioned factors form prerequisites for potential investment volumes recovery in line with scenario of 2010, rather than 2009.

Nonetheless, it’s still early to talk about the upcoming substantial increase in investments in commercial real estate. Risks pf worsening conjuncture still remain quite high. At the same time, the activity of investors with strong financial position and/or pursuing aggressive investment strategies will continue to grow in line with positive signals, coming from macroeconomics and rental rents.

Deals structure

Moscow remain the key destination for investments in commercial real estate market: USD 422, 5 mln., or 96% of all investments. The remaining 4% were invested in St. Petersburg.

The office segment still dominates in investor focus: USD 386 mln., or 88% of the total volumes. The retail sector attracted just USD 39 mln., 0r 9% of total investment, hotels – USD 14,5 mln., or 3% accordingly.

It is noteworthy that in this quarter cross-border investors are the main buyers. Their contribution was as large as USD 341 mln., or 78% of all investments.

Capitalization rates

Yields on Russian Eurobonds (Cbonds index), as an indicator of country risk, increased to 7,6% in late January – early February 2015, or by more than 90 basis points compared to the end of 2014.

After that, during the larger part of February and in March 2015, this indicator was demonstrating sound downward trend, approaching 5% mark. This is 180 basis points below the meaning of this indicator at the end of December 2014.

However, general situation on the CRE market still remains quite controversial, despite some positive signals. To large extent it is driven by insufficient demand for space from tenants.

This situation assumes remaining substantial risks for investors despite the strong positive evolution of the cost of country risk.

Capitalization rates by segment remain unchanged:

• Office – 9,5 – 10%

• Retail – 9,75 – 10,25%

• I&L – 12,5 – 13%.

Salomon elevates brand presence with new Paris flagships

Salomon elevates brand presence with new Paris flagships  Amiri expands presence in California

Amiri expands presence in California  Crocs expands its presence in India with Apparel Group

Crocs expands its presence in India with Apparel Group  Best Buy Canada to expand presence with 167 small-format locations

Best Buy Canada to expand presence with 167 small-format locations  Arket expands into Italy with Milan flagship

Arket expands into Italy with Milan flagship