Documents:

Investor appetite for urban product remains undiminished, boosting pricing year-over-yearBoosted by recent mall acquisitions and increased urban retail investment, retail transaction volumes in the third quarter of 2015 totaled $18.4 billion—a 10.7 percent jump from the second quarter and a 4.6 percent increase year-over-year. Year-to-date volumes are also on the rise, increasing 10.1 percent from the same period of 2014. While premium mall purchases such as Ala Moana Center in Hawaii lifted volumes during the first quarter, steady gains in urban retail investment are helping to boost volumes in the latter half of 2015. Average pricing— at $522 per square foot—simultaneously rose in the third quarter with quarter-over-quarter gains of 8.1 percent and a steady compression of cap rates, down 23 and 16 basis points in the primary and secondary markets, respectively, since year-end.

- Retail investment will continue to concentrate in global gateway markets with a focus on urban / high street retail. Global gateway markets—notably, New York and Miami—continue to be key retail markets for both domestic and international consumers, driving a recent pricing uptick in the markets, both now seeing average per- square-foot pricing exceed $2,000.

- Urban retail’s renaissance make it the most attractive sub-type for investors. Urban retail transaction volume have been trending upward with particular strength in 2014 with a total of $11.8 billion.

- As grocery competition heats up; Fresh-format and specialty stores take the lead. Grocers like Sprouts, Whole Foods and Trader Joe’s are seeing notably higher average per-square-foot pricing relative to traditional supermarkets like BI-LO, ShopRite and Albertsons. This is resulting in a bifurcated pricing environment.

- Weakened demand, leasing fundamentals causing decline in big box buyer depth, paralleling heightened sensitivity to tenant credit and stability. A declining leasing demand and rental rate environment has paralleled a 22.4 percent annual decrease in average per-square-foot pricing, now at its lowest level since 2010.

- Public REITs are selling more than they are buying in 2015. Net REIT acquisition activity has dropped, reaching the first time in which dispositions have exceeded acquisitions since 2009.

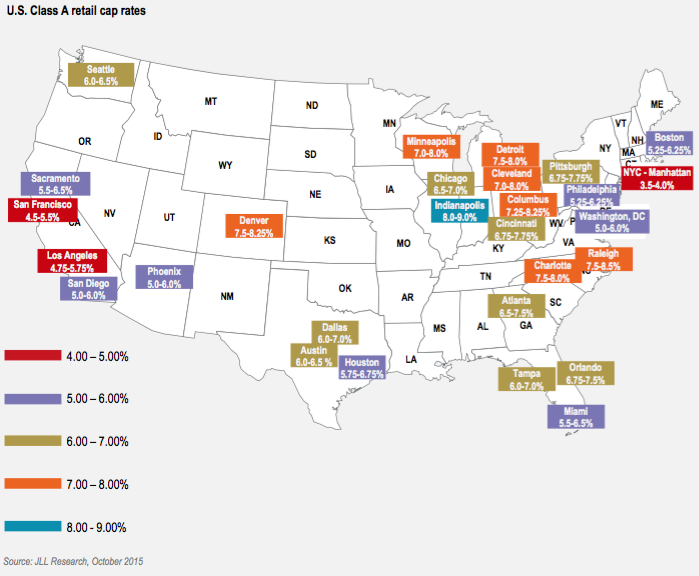

- Primary market retail assets achieving nearly 200-basis-point premium to secondary markets. While most markets now consistently seeing cap rates between 6.0 and 7.0 percent, primary markets trading at sub-6.0 percent levels.

Apple opens its second-largest store in the world

Apple opens its second-largest store in the world  Coach files trademark complaint against Old Navy

Coach files trademark complaint against Old Navy  Ingka opens unique culinary development in downtown San Francisco

Ingka opens unique culinary development in downtown San Francisco  Amazon removes Just Walk Out tech from all of its stores in the US

Amazon removes Just Walk Out tech from all of its stores in the US  McDonald's to acquire franchised stores in Israel

McDonald's to acquire franchised stores in Israel