Documents:

As online shopping continues to grow at the expense of store visits, the premium in the future will be on creating unique, brand-defining experiences that keep customers coming back - whatever the channel.The physical store remains the primary retail touch point for consumers

Retailers and the Age of Disruption

In last year’s Total Retail report, I referred to the high bar that participants in PwC’s global online shopper survey had set for retailers worldwide. In the 12 months since, that bar has been raised higher still, but customer expectations are really just part of the story for retailers in 2015.

In fact, the environment for retailers has never been more complex. In this year’s report, we have reinforced our consumer research with interviews of retailers around the world. Our analysis, both of our survey data and interviews, keeps bringing us back to four waves of disruption facing every retailer, regardless of where they operate: the evolving role of the store, the proliferation of social networks, mobile phone technology, and global demographic shifts.

An expanded and deepened survey

Our global consumer survey now covers more than 19,000 respondents in 19 territories on six continents. The more we expand and deepen this

annual assessment, the more effective it becomes in analyzing and evaluating the international retail landscape.

Some of the results from this year’s survey echo a fundamental principle from last year: namely, that achieving “total retail” demands thinking beyond channels. The more shoppers we canvass in country after country and the more thoroughly we poll them about their consumer habits, preferences, and expectations for a better shopping experience the more obvious it is that consumers are developing their own approach to researching and purchasing, both online and in-store. They want their shopping needs met in a way that minimizes uncertainty and inflexibility and maximizes efficiency, convenience, and pleasure.

Four disruptive forces

This year’s report expands on this total retail discussion and delves into four retail disruptors. Our first disruptor, the evolution of the store, can be thought of more as a business model evolution. Our second and third disruptors mobile technology and social networks are technological. A fourth demographic shifts is more socio-economic.

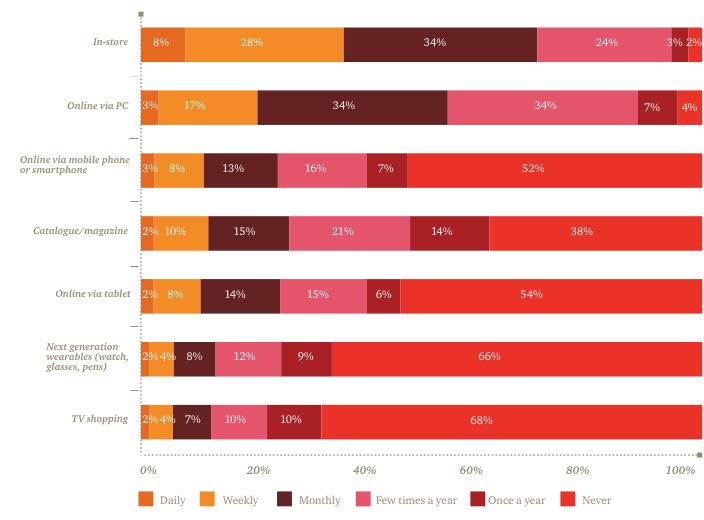

Our first disruptor is centered on an institution as old as modern shopping itself: the store. It’s certainly true that the physical store remains the retail touch point with the highest frequency. More than one in three (36%) of our global sample goes to a physical store at least weekly. That is a significant difference compared to how often they shop weekly online via PC (20%), online via tablet (10%), and online via mobile phone (11%).

But as online shopping continues to grow at the expense of store visits, the premium in the future will be on creating unique, brand-defining (be it offering sheer convenience or an offer that excites and engages) that keep customers coming back.

A case in point is Turkey’s Migros, a leading supermarket chain. The company’s CEO, O. Ozgur Tort, explained to PwC in an interview how Migros’s inventive channel approach uses kiosks to sell online to customers in-store. According to Tort, “The aim is to push e-commerce sales to customers who are already physically shopping in the store, by making them offers for products that are not in the physical inventory of the store.”

As my PwC colleague and the leader of our U.S. Retail & Consumer Practice, Steve Barr, puts it: “From in-store design studios and personal shopping assistants to coffee and tea ateliers, retailers are offering a comprehensive experience, evolving into something sleeker, more customized and increasingly attuned to shoppers’ expectations of what the in-store experience should be.”

It is still very early days for the transformative effects that both mobile and social networks will have on retail. This year’s Thanksgiving shopping weekend was profoundly altered by mobile phones. The Financial Times reported in December that mobile sales on Cyber Monday following Thanksgiving 2014 “increased by a whopping 29.3 percent, to account for one in five transactions” online. A few days earlier, the New York Times, citing IBM data, had also reported significant spikes in purchases by mobile phone on Thanksgiving Day and Black Friday: “Sales from mobile devices jumped over 25 percent on both days.... People logging onto shopping sites from their smartphones or tablets accounted for over half of all online traffic on Thursday, and almost half of traffic on Friday.”

A similar mobile phenomenon was evident in Single’s Day in China, which is the biggest one-day shopping event on the planet. The volume of Alibaba’s sales, for example, made via mobile on Single’s Day in 2014 totaled 43% of the company’s $9.3 billion in sales.

While those increases are impressive and no doubt noteworthy, mobile is still a very small piece of the pie in terms of overall retail sales. But mobile phones are increasingly a critical factor in setting the stage for a purchase. As Matt Hyde, the CEO of West Marine, a major California-based retailer of boat supplies, told PwC: “The importance of mobile is not how many transactions are completed on a mobile phone. The importance is how the consumer is interacting, making decisions, checking information, checking stock, finding your stores, communicating with you through the smart phone. That’s what’s different.”

In other words, the mobile phone is rapidly becoming a crucial shopping agent as shoppers demand more personalization. New York-based social media company Stylinity is focused on smart phone technology that makes it easy for consumers to tag apparel in their “selfies,” and then share those photos with friends via social media. “Everyone knows that consumers are increasingly using mobile phones in store,’ says Stylinity CEO Tadd Spering.

“They are checking prices and getting product information, yes, but also seeking out trusted advice from friends. Ultimately, shopping on a mobile device will be distinct from any other shopping experience.”

Social media as a phenomenon is still in its infancy, and its bottom-line effect on retailing is just starting to be felt. This year’s data suggests that social media’s impact on retail may evolve along two tracks: one for the developing world in which social media becomes more and more part of the daily fabric of shopping, represented most robustly by China, and a separate one for the developed economies, where social media continues to be more of a communications tool rather than a shopping tool.

Our fourth and final disruptor is grounded in demographics. In this year’s survey data, we see very different consumer behaviors when we compare the behaviors of “digital natives,” the 18-24 age cohort that is the first group of adults to have grown up with the Internet, with the shopping behaviors of the rest of our sample. When we looked at their mobile phone shopping frequency against the rest of our survey respondents, for example, our digital natives shopped via phone more than the rest of our sample in every category: daily, weekly, monthly, a few times a year, and once a year. Moreover, just 39% of our digital natives said they never shop via their smart phone, while 56% of other age groups said they never shop via their smart phone.

Another aspect of demographic disruption critical to retailers is global aging patterns. Large swaths of the world, including China, Japan, and many countries in Europe, contain rapidly aging societies.

In some cases, such as that of Japan, an aging society can exacerbate the effects of recession. The good news, however, is that many aging populations are healthier than previous generations of senior citizens, and much more prosperous. Suddenly, retailers can count on a large segment of global consumers with a long track record of spending, and intending to spend into the foreseeable future.

At the same time, India and the nations of Africa continue to get younger, a polar opposite demographic disruption, but also one with positive ramifications for global retailers and consumer goods companies. As GDP growth continues to be robust in these regions (albeit from a small base), millions more consumers will join the middle class every year.

For example, according to the World Bank, Africa’s middle class consumes will grow from approximately 355 million people in 2013 (34 percent of Africa’s population) to 1.1 billion (42 percent of the population) over the next three decades.

I believe that our 2015 Total Retail survey research—coupled with our interviews with retailers—provides a distinctive perspective on the current state of retail. The breadth of this year’s analysis, covering as it does so many countries in every corner of the globe, provides critical data for almost every retailer, regardless of market or base of operations. As always, I hope you enjoy this report and thanks so much for reading.

John G. Maxwell

Global Retail and Consumer Leader

Apple opens its second-largest store in the world

Apple opens its second-largest store in the world  Ingka opens unique culinary development in downtown San Francisco

Ingka opens unique culinary development in downtown San Francisco  Amazon removes Just Walk Out tech from all of its stores in the US

Amazon removes Just Walk Out tech from all of its stores in the US  McDonald's to acquire franchised stores in Israel

McDonald's to acquire franchised stores in Israel  Apple unveils the first images of its new store in Shanghai

Apple unveils the first images of its new store in Shanghai