Documents:

Overview

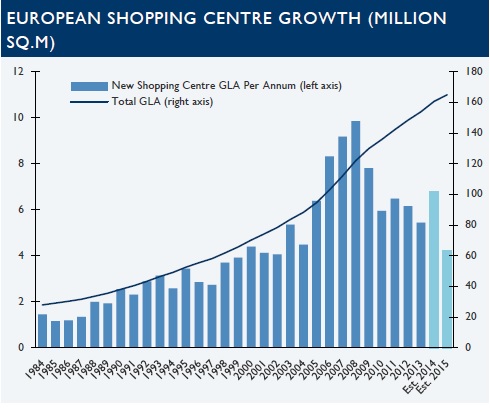

Development activity across Europe picked up considerably in the second half of 2013 as approximately 3.6 million sq.m of new shopping centre GLA were delivered onto the market. This represented double the space completed in H1 2013, albeit the total figure was lower than previous forecasts, with the opening date of a number of projects delayed into 2014.

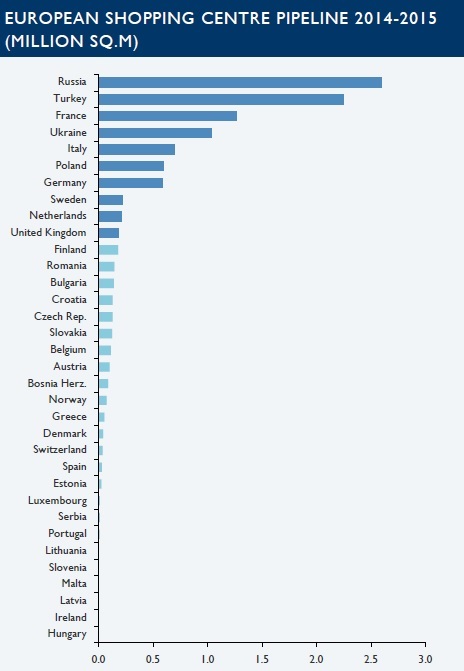

Central and Eastern Europe continued to drive activity, accounting for 69% of all shopping centre space added to the market (2.4 million sq.m). What is more, the region is expected to remain a development hotspot, with 66% of all projected space to be completed in 2014 and 2015 across Europe, 6.8 million sq.m and 4.2 million sq.m respectively, set to be delivered in Central and Eastern Europe. Whilst the pipeline for 2015 is expected to slow, geopolitical concerns in Eastern Europe may lead to the postponements of some projects into next year.

Market size

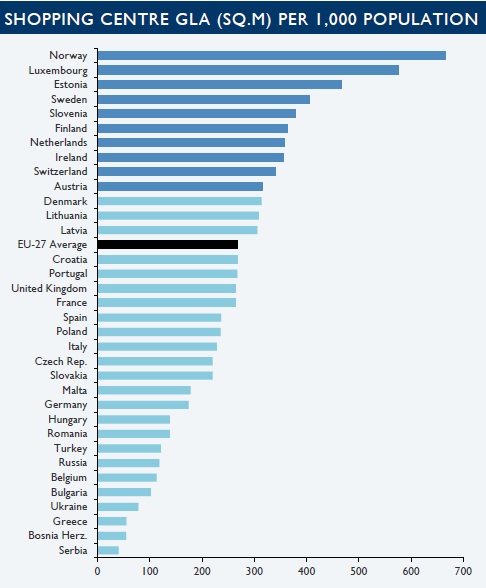

Total shopping centre floorspace now stands at approximately 154 million sq.m of GLA as of the 1st of January 2014. France remains the largest market by shopping centre space, with 17.3 million sq.m of GLA. In addition, it also leads the way in terms of development pipeline among Western European countries and is third overall, with a total of almost 1.3 million sq.m of retail space to be delivered in 2014 and 2015, comprised of several extensions to existing schemes.

The UK follows in second place in terms of open shopping centre flooorsace with a total of 16.93 million sq.m, whilst Russia completed the top three with shopping centre space now exceeding 16.86 million sq.m. As mentioned in previous editions of the survey, Russia is expected to replace the UK as the 2nd largest market in Europe by the end of 2014, with development in the latter country slightly subdued over the next two year – albeit expected to rebound in 2016 with a number of significant projects.

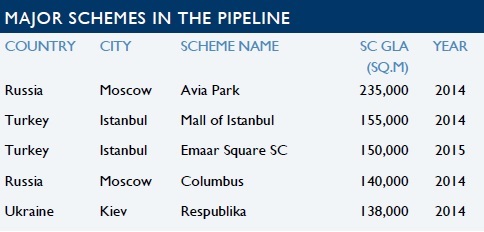

Holding the largest development pipeline in the continent, Russia may also contend for the top spot should most of the projects come to fruition. There remains some uncertainty over the due date of several schemes, but approximately 2.6 million sq.m of shopping centre GLA are expected to be delivered in Russia in 2014 and 2015, including the largest shopping centre set to open in Europe, Avia Park (235,000 sq.m) in Moscow.

Although still a relatively immature market in terms of total shopping centre space per capita (121 sq.m of GLA per 1,000 inhabitants), Turkey is anticipated to benefit fr om the second largest pipeline in Europe, with over 2.2 million sq.m expected to be completed by the end of 2015. Istanbul remains the destination of choice as over half of all schemes are expected to be completed in the city, including two of the largest projects in the continent.

Overview of development in H2 2013

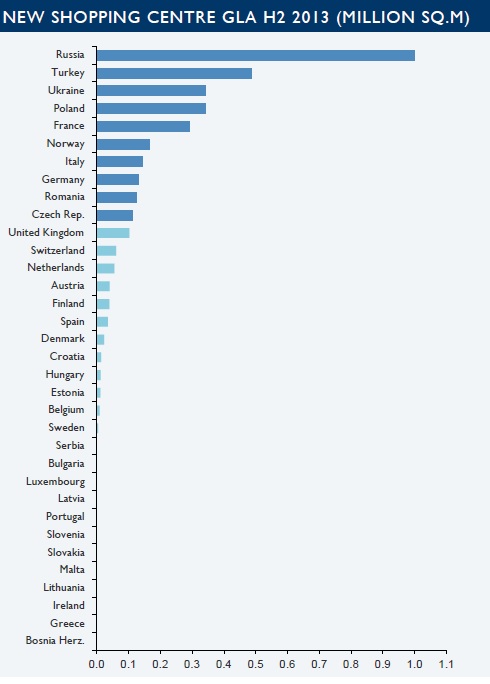

The second half of 2013 recorded approximately 3.6 million sq.m of new shopping centre space, significantly above the 1.8 million completed in H1 2013 and slightly higher than the 3.4 million delivered in the same period in 2012. The main hotspots of development were however mostly unchanged. Russia continued to lead the way with approximately 1.0 million sq.m, accounting for 29% of all space opened across Europe. What is more, the three largest openings of the second half across Europe were all located in Russia, with the first phase of Aero Park City (91,000 sq.m), Kristall (75,000 sq.m) and Planeta (63,440 sq.m) opening their doors.

Turkey was again second as 486,800 sq.m of shopping centre space were delivered in the six months to December, with the largest opening Zorlu (60,000 sq.m) completed in the last quarter of the year. A new entry in the top three was, however, the Ukraine where approximately 340,800 sq.m were added in H2 2013. The top five was rounded off by Poland and France, with 340,700 sq.m and 291,300 sq.m delivered respectively.

The main trends observed over the first half of the year were yet again evident, with the majority of new shopping centres built in Central and Eastern Europe but most extensions completed in Western Europe. Indeed, of the 110 new shopping centres opened, 37 were delivered in Western Europe and the other 73 in Central and Eastern Europe. Conversely, there were 64 extensions of existing schemes completed, with 45 delivered in Western Europe and 19 in Central and Eastern markets.

On the 1st of January 2014, total shopping centre GLA across Europe stood at almost 154 million sq.m, with the average provision per 1,000 inhabitants in the 27 EU member states (excluding Cyprus) reaching 268.3 sq.m. Norway remains the country with the highest shopping centre space density, containing 666.1 sq.m per 1,000 inhabitants.

Key trends across Europe

The focus on the development of new projects was preserved in Russia, with almost 97% of all space completed in H2 2013 consisting of new shopping centres (34). Indeed, just 31,800 sq.m were added to the market in the form of four extensions. A not too dissimilar picture was also manifest in Turkey, where 11 new schemes and two extensions were completed. The two countries again accounted for a large share of completions, with 42% of all new shopping centre space built in these two markets.

The most substantial increase in GLA relative to existing space was recorded in the Ukraine, where total floorspace rose by 10.8%. The country saw 340,800 sq.m delivered, the third largest total in Europe, consisting of nine new schemes and four extensions. The most significant addition in the country was Port City in Mariupol which added 56,000 sq.m to the market.

The considerable space delivered across Poland increased total GLA by 6.9%. New shopping centres such as Galeria Bronowice (60,000 sq.m), Galeria Katowicka (50,500 sq.m) and Trzy Korony (32,000 sq.m) certainly improved provision in the country. However, development was slightly more even than elsewhere in Central and Eastern Europe, with a number of large extensions to existing schemes, such as Poznań City Centre and Wzgórze, contributing towards overall activity.

European shopping centre growth

The European shopping centre development pipeline for 2014 now stands at 6.8 million, with 203 new shopping centres scheduled to be completed in 2014 across Europe, 127 of which will be delivered in Central and Eastern markets. Of the 86 extension set to be opened, 65 will be located in Western Europe. The development pipeline for 2015 amounts to 4.2 million sq.m of GLA, spread across 103 schemes and 32 extensions.

The Ukraine, Turkey and Russia will continue to fuel development across the continent, with all three likely to record double-digit growth in total floorspace. Shopping centre projects in the Ukraine, headlined by Respublika (138,000 sq.m), are expected to enlarge existing space by almost 30% by the end of 2015.

Good growth is also anticipated in other markets, both young but also relatively mature. Four new shopping centres are expected to be added to the underprovided Bulgarian market, which will increase floorspace by 19%, whilst Slovakia is expected to benefit from an increase of 10% as nine new schemes are pencilled in over the next two years.

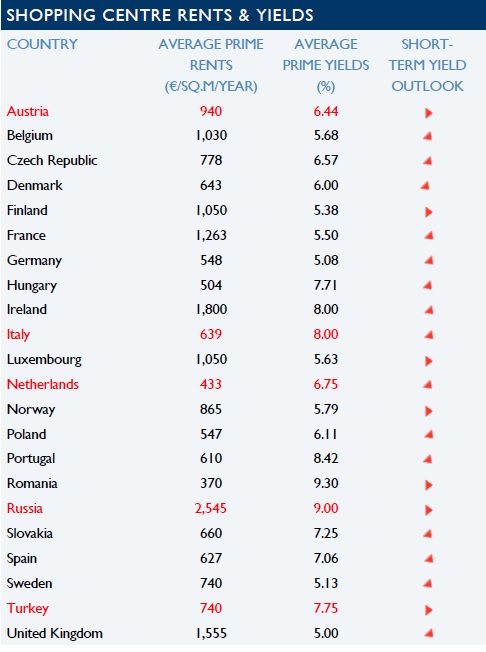

Retail investment

Investment activity across Europe accelerated considerably in the second half of 2013, with €23 billion worth of retail assets traded, bringing the total for the year to €39.6 billion. Indeed, the market witnessed a front loaded recovery and ran ahead of the occupier market towards the end of 2013, with a total of €14.6 billion transacted in Q4, the highest quarterly figure since Q4 2007 and a rise of around 75% compared to the first three quarters.

The big three – the UK, Germany and France – were again at the forefront of this improvement as they increased their share to 60% of all retail investment activity. The UK remained the largest market in the continent, recording approximately €6.5 billion worth of transaction, followed by Germany wh ere volumes rose by 31% on the previous six months, reaching €5.1 billion in H2 2013.

However, the improvement across Europe was broad based with Southern countries seeing a marked rise in acquisitions. Indeed, activity in Italy and Spain in particular was buoyant as investors searching for new markets were met by more realistic re-pricing by vendors. Following the dearth in Italian acquisitions witnessed in 2012 when just €360 million worth of retail assets were traded, a total of €2.1 billion were recorded as investors such as PIMCO and Blackstone were among the most active.

Overall the region saw real signs of economic improvement, better finance availability, firmer occupier markets and a repositioning along the risk curve by investors, all factors which spurred a rise in investment activity. Looking ahead, the strong momentum built in the latter part of 2013 is expected to be maintained this year, but with a shortage of good quality assets and constrained development activity limiting the number of opportunities in some core markets, investors will again be looking further afield in other previously overlooked countries.

Apple opens its second-largest store in the world

Apple opens its second-largest store in the world  Coach files trademark complaint against Old Navy

Coach files trademark complaint against Old Navy  Ingka opens unique culinary development in downtown San Francisco

Ingka opens unique culinary development in downtown San Francisco  Amazon removes Just Walk Out tech from all of its stores in the US

Amazon removes Just Walk Out tech from all of its stores in the US  McDonald's to acquire franchised stores in Israel

McDonald's to acquire franchised stores in Israel